Solar panels for homes offer significant financial benefits through long-term cost savings on energy bills, government incentives, and increased property value. With advancements in technology and growing environmental awareness, these panels provide a lucrative investment opportunity. The installation process involves site evaluation, panel mounting, wiring, and testing. Future trends include higher efficiency rates, smart grid integration, and decentralized energy solutions. Investing in solar panels supports sustainability while offering potential for significant financial returns.

The shift towards sustainable energy sources has gained unprecedented momentum, with solar panels for homes emerging as a prominent player in this transformation. Investors, recognizing the potential for both significant returns and societal impact, are increasingly turning their attention to this burgeoning market. However, navigating the complexities of solar panel technology, economic considerations, and regulatory landscapes can be daunting. This article provides an in-depth overview, equipping investors with the knowledge needed to make informed decisions regarding solar panels for homes. By unraveling the intricate details and presenting a clear path forward, we aim to empower investors to capitalize on this clean energy revolution.

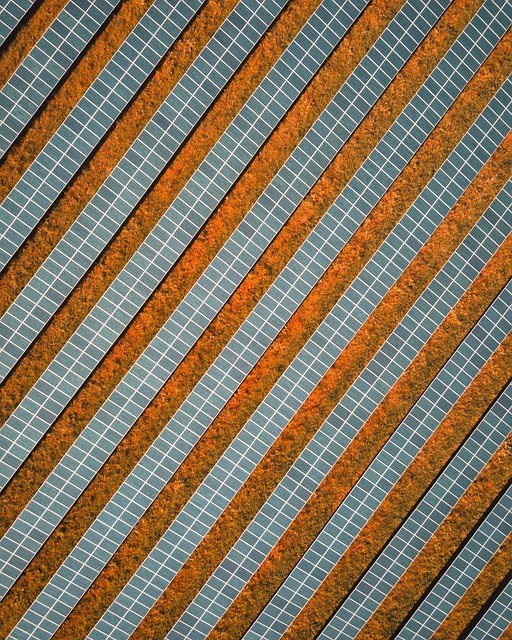

Understanding Solar Panels for Homes: A Basic Guide

Solar panels for homes have emerged as a compelling investment opportunity, driven by rising energy costs and growing environmental awareness. To fully understand the potential of this sector, borrowers must grasp the fundamentals of solar panel technology and its integration into residential settings. At their core, solar panels convert sunlight into electricity through photovoltaic (PV) cells, which generate direct current (DC) power that can be converted to alternating current (AC) for use in homes. This clean energy source not only reduces utility bills but also contributes to a more sustainable future.

One of the key advantages of solar panels for homes is their ability to offset electricity costs significantly over time. While the initial installation involves a substantial investment, many governments offer incentives such as tax credits and rebates to encourage adoption. For borrowers, understanding these financial benefits is crucial when assessing solar panels for homes—it’s not just about the upfront cost but also the long-term savings. Studies show that residential solar installations can provide a return on investment (ROI) of 20-40% over a decade, making them attractive from both an environmental and economic perspective.

Borrowers interested in solar panels for homes should also consider the evolving borrower requirements. Lenders are increasingly incorporating renewable energy projects into their assessment criteria, recognizing the stability and growth potential of this sector. This trend is reflected in easier access to financing and more favorable loan terms for qualified borrowers. For instance, some financial institutions now offer dedicated solar loans with lower interest rates and flexible repayment plans, further incentivizing the adoption of solar power. As the technology continues to advance and costs decline, investing in solar panels for homes is not just a smart environmental choice but also a prudent financial decision for borrowers looking towards long-term savings and resilience against rising energy prices.

The Benefits of Investing in Residential Solar Energy

Investing in solar panels for homes offers a compelling opportunity for financial growth while contributing to a sustainable future. The benefits extend beyond environmental impact; they directly translate into tangible advantages for investors. One of the most significant advantages is the potential for long-term cost savings. Homeowners with solar installations can significantly reduce their electricity bills, as solar panels harness the power of the sun, providing free energy for years to come. This shift towards clean energy sources also stabilizes utility costs, shielding homeowners from unpredictable price fluctuations in traditional energy markets.

Furthermore, many governments and local authorities offer incentives to promote residential solar energy adoption. These incentives can include tax credits, rebates, or net metering policies, where excess energy generated by solar panels is fed back into the grid, providing a credit on future electricity bills. Such initiatives make initial investment costs more manageable and speed up the payback period. For instance, in regions with robust solar policies, investors can expect attractive returns on their solar panels for homes within 5–10 years, making it a lucrative venture.

When considering solar panels for homes, borrowers should evaluate their financial situation and long-term goals. Lenders often require a minimum credit score and stable income to qualify for loans. The borrower requirements for solar panel installations vary based on location and lender policies, but maintaining good credit and demonstrating a consistent income stream can improve access to financing options. Investors should also explore the potential appreciation of their property value due to the addition of renewable energy features, further enhancing the overall return on investment.

How Solar Panels Work: Unlocking Clean Power

Solar panels for homes have emerged as a powerful tool in the transition towards clean and sustainable energy. Understanding how these innovative technologies work is crucial for investors looking to capitalize on this growing market. At their core, solar panels for homes harness the power of sunlight, converting it into electricity through the photovoltaic (PV) effect. When photons from sunlight strike the semiconducting material in a solar panel, they knock electrons loose, creating a flow of direct current (DC) electricity.

This DC power is then funneled through an inverter, which converts it into alternating current (AC) electricity—the standard form used by most homes and businesses. The efficiency of this process has improved dramatically over the years, with modern solar panels achieving efficiencies ranging from 15% to 22%. For example, a typical residential solar panel system can offset around 30-50% of a home’s annual electricity needs, significantly reducing energy costs for homeowners and providing attractive returns on investment.

For potential borrowers considering solar panels for homes, understanding the associated costs and benefits is essential. Initial installation expenses can vary widely based on system size, location, and local incentives. However, many governments offer tax credits, rebates, and other financial incentives to promote adoption of solar energy. These incentives can significantly reduce upfront costs, making solar panels for homes a more affordable option. Moreover, the long-term savings on electricity bills can provide a substantial return on investment, with some systems paying for themselves within 5-10 years. As the technology continues to advance and costs decline, solar panels for homes are poised to become an increasingly attractive investment opportunity.

Financial Analysis: Solar Panel Investments for Homes

Solar panels for homes have emerged as a lucrative investment opportunity, particularly with the growing focus on renewable energy and sustainable living. When considering solar panel investments, a thorough financial analysis is paramount to assess the viability and potential returns. This in-depth overview will guide investors through the process of evaluating the financial aspects of solar panel installations in residential settings.

The initial step involves understanding the cost structure associated with solar panels for homes. Installation expenses typically encompass equipment, labor, and permitting fees. Recent advancements have led to a significant drop in panel costs, making them more accessible to homeowners and investors alike. For instance, the average cost of solar panels has decreased by approximately 80% over the past decade, according to the International Renewable Energy Agency (IRENA). This trend demonstrates the market’s maturity and accessibility of solar technology. Moreover, many governments offer incentives and rebates to encourage the adoption of solar power, further reducing upfront costs for borrowers. These incentives can range from tax credits to grants, varying by region, and should be carefully considered in any financial analysis.

Borrower requirements play a pivotal role in the financial viability of solar panel investments for homes. Lenders typically assess creditworthiness, income levels, and debt-to-income ratios before extending financing options. Solar loans are often structured as either a standard mortgage or a home equity loan. The former is suitable for borrowers with strong credit histories and stable incomes, while the latter caters to those looking for lower monthly payments but may have less-than-perfect credit. According to a study by the U.S. Energy Information Administration (EIA), homeowners who install solar panels can save up to 20% on their energy bills, leading to attractive returns on investment over time. Additionally, property values in areas with high solar adoption rates tend to appreciate, offering long-term financial benefits.

Investors should also consider the potential for passive income generation through net metering policies. This allows homeowners with excess solar energy to feed it back into the grid and receive credits or payments from their utility companies. Such arrangements can significantly enhance the financial viability of solar panel investments for homes, especially in regions with high electricity rates. Furthermore, diversifying one’s investment portfolio by incorporating renewable energy assets like solar panels can mitigate risk and offer long-term stability, making it an attractive option for both individual investors and institutions alike.

Installation Process: From Start to Finish

The installation process of solar panels for homes is a meticulous journey that involves several key steps, from initial assessment to final activation. It’s a complex yet rewarding endeavor for investors looking to incorporate renewable energy solutions into their real estate portfolios. The first stage comprises site evaluation, where professionals inspect the property to determine the optimal placement of solar panels for homes, taking into account shading, roof condition, and sunlight exposure. This critical analysis ensures the system’s efficiency and longevity.

Once the planning is in place, the actual installation kicks off with precise measurement and cutting of the roof to accommodate the panels. Experienced technicians meticulously secure the solar panels for homes, employing high-quality mounting systems that can withstand various weather conditions. Wiring and electrical integration follow, connecting the panels to the home’s power grid or battery storage system, depending on the setup. This phase demands adherence to stringent safety protocols and local regulations to guarantee a safe and compliant installation.

Post-installation, testing and activation are crucial milestones. Technicians conduct thorough checks to ensure the solar panels for homes operate seamlessly, meeting the borrower requirements set by financial institutions. Once activated, homeowners can begin enjoying the benefits of clean energy generation, potentially reducing electricity bills and contributing to a more sustainable future. This process, while intricate, is a vital step towards embracing renewable energy technologies and attracting environmentally conscious borrowers in today’s market.

Future Trends: Solar Panel Evolution for Homesteads

The future of solar panels for homes is brimming with innovation, presenting investors with exciting opportunities to capitalize on clean energy trends. As the global shift towards sustainable living gains momentum, understanding the evolving landscape of solar panel technology is paramount. Solar panels for homes are no longer a niche concept but an integral part of the modern real estate investment strategy. This technological advancement offers not just environmental benefits but also significant financial returns for savvy investors.

One of the most promising trends shaping the market is the continuous improvement in panel efficiency. Manufacturers are consistently developing more sophisticated solar cells, enhancing power output and reducing production costs simultaneously. For instance, recent advancements have led to the creation of high-efficiency monocrystalline panels, delivering up to 22% conversion rates—a stark contrast to the industry standard of around 15-18%. This evolution directly translates to increased profitability for homeowners and investors alike, making solar energy a more attractive proposition. Moreover, the integration of smart grid technologies and storage systems further stabilizes the reliability and value of solar-powered homes. As we move forward, it’s expected that these innovations will make solar panels for homes even more accessible and cost-effective.

Investors should also consider the growing demand for decentralized energy solutions. With the rise of microgrids and community solar projects, homeowners now have more options to go off-grid or reduce their reliance on traditional utility providers. This trend opens doors for investors to participate in local renewable energy initiatives, fostering a sense of community while reaping financial benefits. For example, community solar farms allow residents to invest in shared panels, providing them with clean energy at a reduced cost. Such models not only drive adoption but also ensure borrower requirements are met through collective funding and risk mitigation strategies. As the market matures, staying informed about these trends will empower investors to make informed decisions regarding solar panel installations for homes, securing a sustainable and lucrative future in renewable energy.